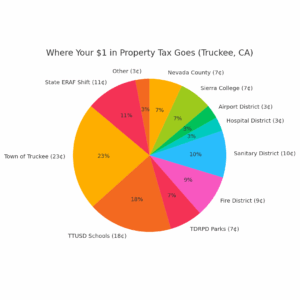

Q: Who receives my property taxes in Truckee, California?

A: Property taxes in Truckee are split among more than 10 different public agencies. Each $1 of your base property tax (1% of assessed value) is divided approximately as follows:

- Town of Truckee: $0.23

- Tahoe-Truckee Unified School District: $0.18

- Truckee Donner Recreation & Park District (TDRPD): $0.07

- Truckee Fire Protection District: $0.09

- Truckee Sanitary District: $0.10

- Tahoe Forest Hospital District: $0.03

- Tahoe-Truckee Airport District: $0.03

- Sierra College District: $0.07

- Nevada County (General Fund): $0.07

- Other (Cemetery, Resource Conservation District, T-TSA): $0.03

- State Education Shift (ERAF): $0.11 (from above agencies)

Q: How is sales tax allocated in Truckee?

A: Truckee has a 9.0% sales tax rate. Breakdown:

- 6.0% to the State of California

- 1.0% to Town of Truckee (general services)

- 0.5% Measure V (road maintenance)

- 0.5% Measure U (trails and recreation)

- 1.0% to county/statewide purposes (public safety, transit)

Q: Which agencies have the largest budgets and responsibilities?

- Town of Truckee: Maintains roads, police, snow removal, planning. $40M+ budget.

- Truckee Fire Protection District: Fire & EMS. $16M+ budget.

- Truckee Donner PUD: Electricity and water. $44M+ budget (ratepayer funded).

- Tahoe Forest Hospital District: Medical services. ~$3.5M from taxes; total budget $100M+.

- TTUSD: Public schools. $75M+ general fund, majority from property taxes.

Q: Are there any overlapping services or administrative duplication?

A: Yes. Truckee has many independent agencies, each with its own board, finance team, HR, and general manager. For example:

- Parks and recreation is managed by TDRPD, not the Town.

- Sewer is split: Truckee Sanitary District collects wastewater; T-TSA treats it.

- Each agency has its own finance department.

Q: Why so many agencies?

A: California’s special district system allows focused service delivery but leads to administrative fragmentation. In Truckee, this means high local control but multiple layers of governance.

Q: How can I see where my tax dollars go?

A: Check your property tax bill. It lists exact dollar amounts and percentages allocated to each agency. Also, review public budgets:

- Town of Truckee: www.townoftruckee.com

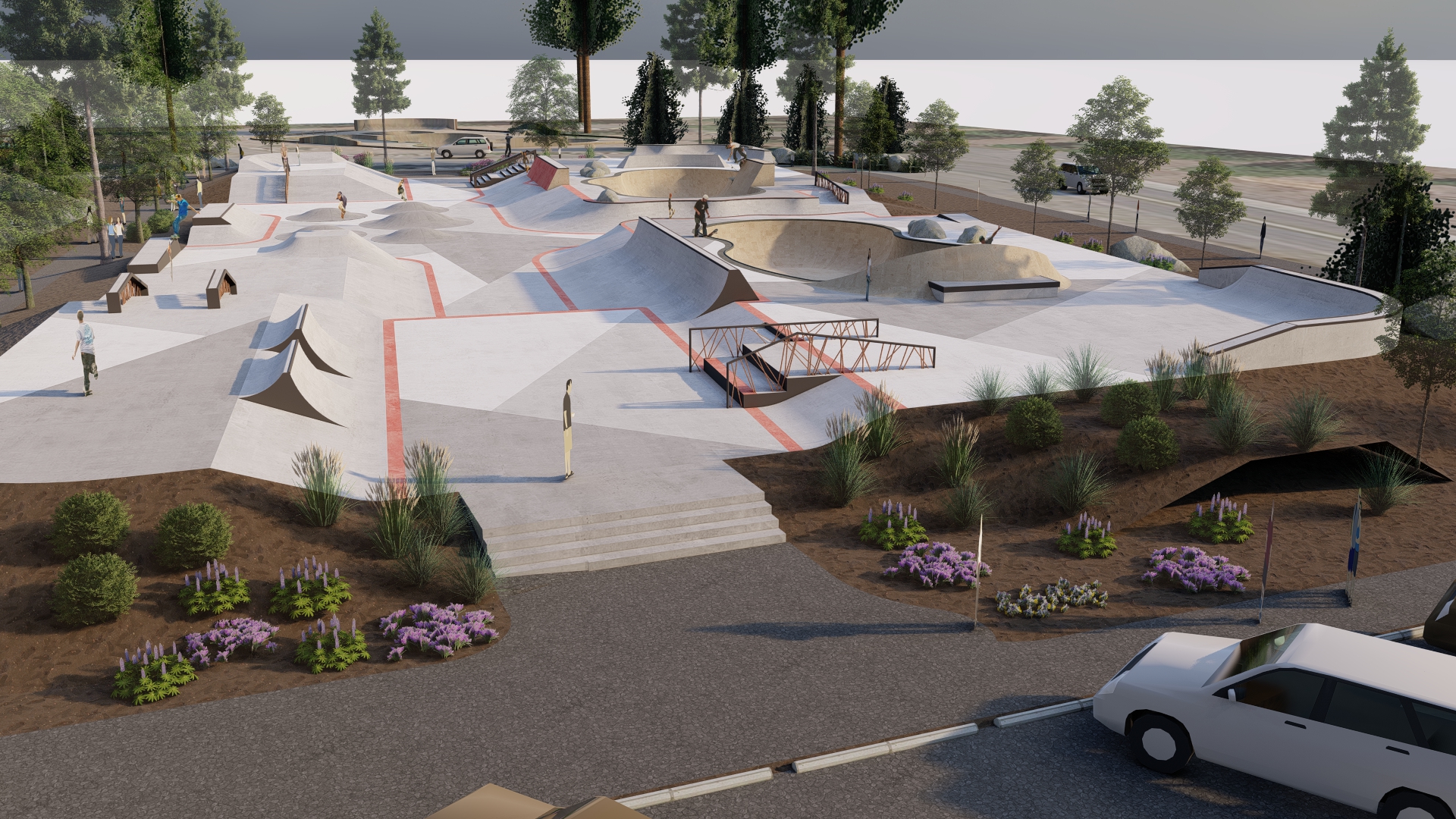

- TDRPD: www.tdrpd.org

- Truckee Fire: www.truckeefire.org

- TDPUD: www.tdpud.org

- TTUSD: www.ttusd.org

Q: Is anyone trying to improve efficiency?

A: Some agencies partner on trails, recreation, and wildfire response. Ideas like shared HR or finance functions are discussed but limited by legal and political boundaries.

Bottom Line: Your taxes fund a complex web of local and regional agencies. Each agency provides essential services, but administrative duplication is a challenge. Transparency and cooperation among agencies can help improve efficiency.